Xennials, Watch Out for These Top 4 Money Mistakes

Are you a millennial that hates being called a millennial?

Do you cringe at #filtered photos of man buns and avocado toast?

Do you even know what The Macarena is?

If you answered yes to these questions, chances are that you’re a special type of millennial – Xennials. Unlike younger millennials, you remember life without the Internet. Educational games like The Oregon Trail were cool. Instead of Mean Girls, your friends memorized quotes from Clueless.

However, because Xennials are much different from their younger counterparts, this means their financial needs are different as well. Unfortunately for you, much of the financial advice given to millennials doesn’t take into account these drastic differences between these groups.

In this post, we’ll map out four of the most common money mistakes we see from Xennials. Learn from them and avoid them, so you can come out on top.

1. Not investing in stocks.

September 15, 2008.

Do you remember the day Lehman Brothers filed for bankruptcy? What about October 3, 2008? The day President George W. Bush signed the “bank bailout” into law? Or perhaps you remember September 17, 2011 – the day the Occupy movement held its first protest in New York City?

Of course you remember – you’re an Xennial.

You didn’t just hear about the Great Recession, you experienced it. While younger millennials were turning in high school homework, you were busy figuring out how to pay off student loans without a job. Everyone around you – friends, family, neighbors, and coworkers – were losing their homes, their jobs, and their retirement funds. Thanks to this generation-defining moment, it’s no wonder that the stock market has you nervous.

But your failure to invest in stocks is still a mistake.

Here’s why:

Recessions in the United States occur every 5 to 15 years.

a. Recessions are a normal part of life. Don’t be scared – get prepared.

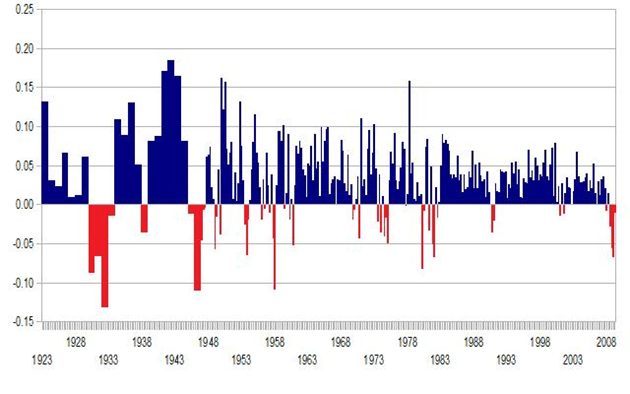

Many factors contributed to an exceptional Great Recession (for more information on this, we highly recommend watching The Big Short). But recessions are still a natural component of the business cycle. For an illustration of this, take a look at the following graph which maps each recession in red from 1929 to 2009. As you can see, recessions in the United States occur every 5 to 15 years.

Because recessions happen every 5 to 15 years, there’s no need to worry about when a recession will happen. You already know that the next one is right around the corner. Instead of being scared, stay prepared. Save money for an emergency fund – at least six months’ to a year’s worth of your expenses – so you can comfortably ride out the storm.

Once you reach your target savings goal, you can invest the rest.

b. Staying out of the stock market means risking your financial security.

Simply put, your cash savings aren’t enough to cover retirement.

Your income alone limits how much cash you can save every month. Unless you exponentially increase your income over time – with plans to survive on only a tiny fraction – your cash will never be enough. For an illustration of this, use this retirement calculator to compare how much cash you need for retirement vs. how much cash you will actually have.

In addition to your cash savings not being enough, the actual value of your cash decreases every year. This happens because of inflation. Every year, the price of all goods and services in the United States increases by about 2 percent. This means that inflation causes your cash savings to erode in value by 2 percent every year.

Investing in the stock market can help you hedge against these risks.

If your company has a 401k plan, start there.

c. Getting started with investments is much easier than you think.

Investing in the stock market isn’t what it used to be.

You don’t need to be wealthy and you don’t need to deal with sketchy, Wolf of Wall Street brokers. You don’t even need to know a lot about stocks. Thanks to the rise of robo-advisors, you can invest as little or as much as you want toward total stock market index funds. Stocks and bonds are more accessible than ever, and technology advancements are making it much easier to be a lazy investor.

If your company has a 401k plan, start there. Most companies will match your contribution up to a certain percentage. If your company has a dismal or non-existent 401k plan, another option is to work with robo-advisors such as Betterment, WealthSimple, or Vanguard. These firms can help you build a simple, low-cost Individual Retirement Account (IRA).

As your financial needs become more complex, you can work with an advisor to ensure you’re on the right path.

2. Not boosting retirement savings after a raise.

Another common mistake made by Xennials is failing to leverage a raise for more retirement savings. Instead of boosting their retirement, they succumb to the nefarious financial phenomenon called lifestyle inflation.

Here’s how the story typically goes – you earn a comfortable salary and contribute 6 percent to your 401k for employer match. You live a decent lifestyle – not lavish, but enough to feel satisfied.

At the end of the year, you gladly accept additional work responsibilities in exchange for a 10 percent raise. You celebrate with a nice dinner, upgrade your home with a few extra furnishings, and maybe sign up for that style subscription box your friends have been talking about.

Lifestyle inflation is quick to happen and difficult to spot.

Before you know it, a year passes by and that raise is no longer a big deal. Your expenses have increased, and now you’re wondering how to maximize your income even further.

See what just happened?

Lifestyle inflation is quick to happen and difficult to spot. If you’re not careful, you will continue to increase your cost of living without increasing your actual wealth.

Here’s what you must do instead:

First, calculate how much you truly need for retirement. According to a study by Fidelity Investments, 75% of Americans underestimate how much money they need for retirement. And that number doesn’t take healthcare into account – some retiree couples will need up to $400,000 extra in savings to cover healthcare expenses. Use this retirement calculator from NerdWallet as a starting point.

Next, pay yourself first. Until you are on track to reach your retirement goals, your money does not belong to you – it belongs to “Future You.” This means every raise you receive must be used to boost your retirement and ensure you can live comfortably during your golden years. Once you’re on track (and your emergency fund is well funded), you can enjoy your raise and live a little.

Your 401k is not your emergency fund. Keep your emergency and retirement savings separate.

3. Only saving money in your 401k.

If you’re a Xennial who is already contributing to a 401k, great! Just make sure your 401k is not your only savings account. A 401k is an excellent vehicle for retirement savings, but your 401k is not your emergency fund. Keep your emergency and retirement savings separate.

Why?

First, if you pull money out of your 401k before the age of 59 1/2, you will automatically incur a 10 percent penalty. On top of this penalty, you will also have to pay taxes according to your income bracket. For example, if you are in the 22 percent tax bracket and pull $5,000 out of your 401k to cover an emergency, you will lose an additional $1,600 from penalties and taxes.

Second, when you make an early withdrawal from your 401k, you’re not just losing the principal. You’re also missing out on extra earnings that your principal would have generated over time.

For example, let’s take a look at two hypothetical 35-year old millennials, Ashley and Josh.

Ashley and Josh both earn $70,000 per year, both contribute 10 percent of their salary toward retirement, and they each have $50,000 stored in retirement accounts. Coincidentally, Ashley and Josh both experience a $5,000 financial emergency, but – while Ashley uses her emergency savings to cover it – Josh must use his 401k instead.

The following table illustrates what happens over time when you make an early 401k withdrawal. (For simplicity’s sake, we’ll assume the salary and retirement contributions are constant and both millennials earn a 7 percent annual return from the market.)

| Initial Balance | 1 Year Later | 10 Years Later | 25 Years Later | |

|---|---|---|---|---|

| Ashley No early withdrawal |

$50,000 | $60,499.96 | $195,072.15 | $714,112.37 |

| Josh $5,000 early withdrawal |

$45,000 | $55,149.96 | $185,236.39 | $686,975.20 |

After 25 years, Josh’s $5,000 early withdrawal cost him an additional $27,137.17 in missed earnings! Although a $5,000 early withdrawal seems small at first, it can cause a large retirement deficit over time.

Don’t be like Josh – build an emergency fund of six months’ to one year’s worth of expenses and allow your retirement accounts to earn their full potential.

4. Putting your children’s financial needs before your own.

While younger millennials call their pets fur babies, Xennials like you may have actual human children to worry about. And, naturally, you want to provide your child with the best. Organic homemade meals, quality family time, and (of course) a college education fully funded by mom and dad. As someone who understands the struggle of paying off student loans, you want your child to avoid this burden.

However, if you are providing for your child at the expense of your own financial security, you are making a huge mistake.

And you wouldn’t be alone. Most millennial parents prioritize their children’s education over retirement and medical emergencies1. Meaning, if a millennial parent had to choose between saving for their child’s education and saving for their own retirement, college education would win every time.

Now, just to be clear – funding your child’s education is a terrific idea. Doing so at the expense of your own retirement, however, will only backfire down the road. What happens when you don’t have enough for retirement and your adult child feels obligated to care for you indefinitely? Thanks to chronic illness and increasing lifespans, caring for an elderly parent is a much larger burden than student loans.

Here’s what you must do instead:

While it’s noble to want to save for your child’s education, you must put your own financial needs first. This means calculating how much money you need to live comfortably during retirement and ensuring you are meeting each retirement savings benchmark. If you have money left over to save for your child’s education, great! If not, so be it.

Even if your child has to take out student loans – it’s far better for your child to have student debt than to be responsible for an elderly parent’s health and finances. When it comes to financial security, you must put your own oxygen mask on first.

Aim for progress, not perfection.

If you find that you’re making many of the above mistakes, don’t fret. When it comes to financial preparedness, progress is the important piece, not perfection. Your job is to ensure that you are making ample progress so you reach closer to your goals over time.

If you’re looking for high-yield accounts to boost your savings goals, we invite you to take a look at our IRA options and savings accounts.

Footnotes

1.“Millennial parents, still in debt, plan to pay for children's education”, USA Today, March 28, 2017, https://www.usatoday.com/story/news/nation-now/2017/03/28/millennial-parents-still-debt-plan-pay-childrens-education/99729236.

Xennials, Watch Out for These Top 4 Money Mistakes

This blog post was published by Axos Bank on April 22, 2019 and last updated on April 22, 2019.